Most people dream of living happily without worrying and working for their everyday necessities. It’s the ideal life where we can pursue our passions freely and live our lives to the fullest. This goal many of us are working towards is a life of financial independence.

Understanding What Is FI?

Before we fully explore the dream life of financial independence, let us first ask: What does FI mean?

From the word itself, being financially independent means having sufficient personal wealth to live the rest of your life without needing to work and earn an active income. That means no need to wake up at 7 AM, head to the office, and work at your desk from 8 to 5. Your personal wealth sustains your lifestyle and living expenses without having to rely on being employed or receiving financial support from others.

For instance, many turn to financial institutions like banks and credit unions to manage their savings effectively, ensuring their money grows over time. Avoiding a common mistake like neglecting these services can make a significant difference in building wealth.

Definition of Financial Independence, Retire Early (FIRE)

While financial independence is the first part of the dream life, retiring early is the second. The Financial Independence, Retire Early, or FIRE, movement is all about a lifestyle of making aggressive financial decisions so that we can become financially independent and retire far earlier than the traditional retirement age of 60. Through aggressive savings, investments, and financial planning, we can reach financial independence at a young age and enjoy the freedom of retired life for decades to come. This approach often involves dealing with investment banks or other financial institutions to optimize returns.

The FIRE movement became popular after the 1992 best seller, “Your Money or Your Life,” by Vicki Robin and Joe Dominguez, brought attention to its philosophy. The book guides readers through a nine-step program toward the goal of achieving financial independence. It explores how people apply FIRE in their lives and encourages us to rethink our relationship with money in our lives.

As Vicki writes in the 2018 edition of their book, “There is a way to approach life so that when asked, ‘Your money or your life?’ you say, ‘I’ll take both, thank you.’” This word of wisdom continues to spark inspiration across countries worldwide .Many find it helpful to watch a video summarizing the book’s key principles to better grasp its teachings.

Purpose and Benefits of Achieving Financial Independence

Financial independence is about having enough money to live our lives comfortably without having to work and earn money eight or however many hours a day. However, this dream life isn’t just about avoiding work. FI gives you freedom in your life to choose what you want to do, whether that’s doing work you’re passionate about, learning new skills that interest you, or pursuing other dreams and goals. For instance, businesses focused on insurance products often market to customers seeking FI, offering tools to secure their financial future.

Tyler Seeger, managing director at Retirement Being, said it best in an article about becoming financially independent . He says, “It’s about being free to choose how to live your life and spend your time without worrying about your next paycheck.” This point resonates deeply with those who hope to achieve FI.

Have you ever had to make the choice between a cushy job that pays well but you don’t enjoy and a job you’re passionate about but isn’t enough to support you? Achieving FI means we’re free to choose the job we truly want. It means we can freely follow our passions. Money stops becoming a deciding factor in many of our life choices. With this independence, we can live our lives on our own terms. Financial institutions play a critical role here, offering services like deposits and loans to help consumers build wealth. These services are related to creating a stable financial foundation for long-term freedom.

The Path to Financial Independence

Tanja Hester, the author of “Work Optional,” says in a Forbes article, “In order to do something like retire early, you’re going to have to go through several financial milestones. It’s understandable why you might see it as a hurdle, but it’s just another thing to figure out, just like figuring out how you’re going to fund your early retirement years, how you’ll fund your traditional retirement years or how you’re going to get health care.” Engaging with regulators like the FDIC can provide confidence that your savings are protected, making this journey smoother.

The path to FI is not straight and easy. Understanding our financial health, personal situations, and the current economy means we are able to make informed decisions about our financial independence. Banking services, such as those offered by financial institutions, provide the tools needed to track and grow wealth effectively. It’s expected that individuals will need to adjust their strategies over time to stay on course.

Factors That Influence Financial Independence

Each person’s financial situation is unique, and to achieve FI, we need to understand the key factors that influence it.

1. Income and Savings Rate

How much we earn from our work affects how much we’re able to save and what we can invest for the future. Connected to income, our savings rate is the percentage of what we earn that we save. The FIRE movement focuses on having a high savings rate of up to 50% to 70% of our income. The higher the rate, the faster we’ll be able to gain FI and retire early. Deposits placed into high-yield savings accounts at financial institutions can accelerate this process.

Additionally, reinvesting our earnings creates a great opportunity to increase our wealth. Our investment returns from a diversified portfolio can greatly contribute to our future financial security. Exploring different types of investments, such as those offered by businesses or intermediaries, can further enhance growth.

2. Expenses

While our income, savings rate, and investment returns are about how much money we put into our future life, expenses take a look at how much we spend. Food, housing, and daily necessities make up the cost of living. Debt can also become a big hurdle to overcome toward FI. However, through effective budgeting and minimizing debt, we can lower our expenses and increase our savings rate. Avoiding mistakes like overspending, often cautioned by regulators, helps maintain control over finances.

3. Lifestyle Choices

The lifestyle choices we make can guide us through vital financial decisions on the path to independence. From choosing to live a minimalist lifestyle to taking care of our health and wellness, we can reduce our expenses and save much more effectively. Opting for cost-effective insurance plans from financial institutions can protect your savings.

4. Economic Factors

Economic issues such as inflation, interest rates, and market performance are factors that are outside of our power but can influence our path to FI. It can affect the value of our investments, how much we spend for the cost of living, and more. Staying engaged with banking trends and currency exchange rates can help navigate these challenges, especially for those investing in countries with volatile markets.

7 Steps to Achieve Financial Independence

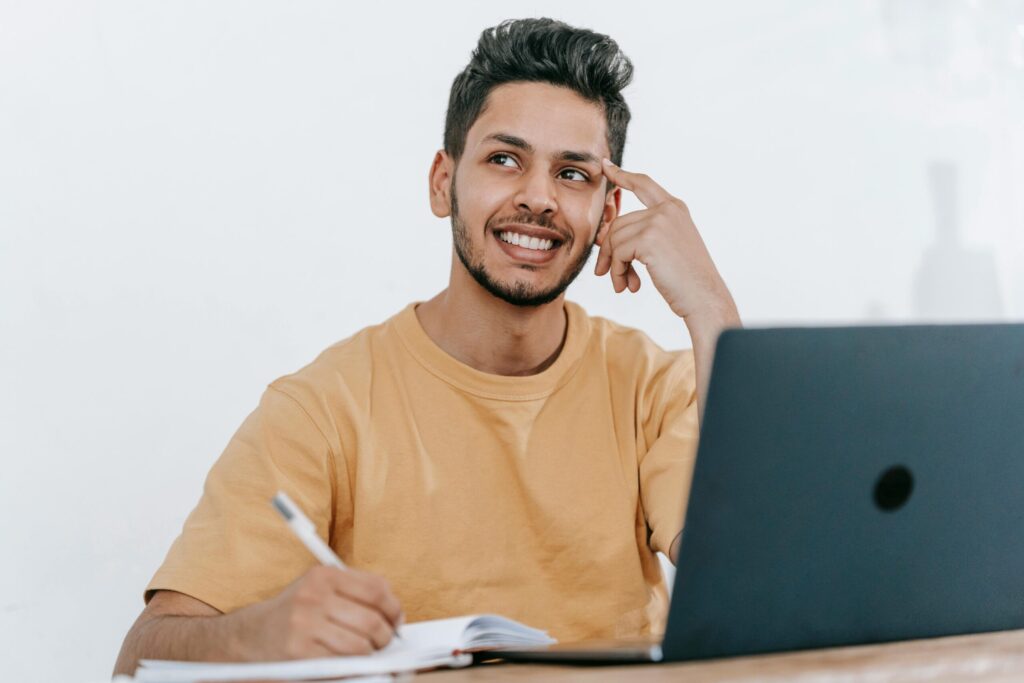

Achieving FI is a goal that can take years to reach. During this journey, we have to make important financial decisions, be proactive about our financial health, and be smart in planning and managing our finances. Here are 7 crucial steps we can take to become financially independent:

1. Set Clear Goals

What does FI mean to you? Having a clear definition can guide the choices we will make and shape the future we want to have. Questions like what our desired lifestyle, how much personal wealth is enough to be financially independent, and when do we want to retire, can give us concrete goals we can move towards to. Using tools like budgeting apps from financial institutions can help set these goals.

Remember! Make sure your goals are SMART—specific, measurable, attainable, relevant, and time-bound. This style of goal-setting is commonly used to gain traction toward FI.

2. Assess Your Current Financial Situation

As we set our goals, we have to keep in mind our personal financial situations. This includes keeping track of our income, expenses, debts, savings, investments, and any other assets and liabilities we may have. Understanding where you stand financially can set the foundation for realistic goals toward FI. Banking platforms often provide tools to visualize this data on a table for clarity.

3. Create a Spending Plan

Budgeting is a crucial part of financial planning. Creating a spending plan makes sure that we’re not going negative, saving enough income despite any expenses we have. Beyond that, a budget helps us keep track of how much we spend and where our money goes. It gives us the opportunity to ask the answer-driven question, is this an essential expense or an unnecessary bill? Developers of budgeting apps, often backed by financial institutions, make this process easier.

Our spending plan should be designed based on how much we earn and our necessary expenses, as the developer of these app intended. Remember to keep your financial goals in mind when deciding how much you should spend and how much you should save. Insurance policies can also be factored in to protect your budget.

4. Increase Your Income

Just like we learned earlier, one of the biggest factors of FI is how much we earn. A few of the best ways to increase your income include seeking opportunities to grow your career, finding passive income, and starting side hustles for additional earnings. Businesses offering freelance tickets or gigs can be a great starting point.

The greater the income, the more money we have to save and invest. It’s the main source of the wealth we’re building for FI. Know that banking services can help manage these additional income streams effectively.

5. Manage and Minimize Debt

Debt can hold us back from saving more money and take up a big chunk of our budget with its monthly payments. Student debt, credit card debt, and more are a few examples of loans many of us struggle with. We can manage our finances by prioritizing high-interest debt to avoid gaining more interest to pay over time. It’s also crucial to take care and avoid taking on new debts through financial planning and budgeting. Financial institutions often provide loans with favorable terms to consumers aiming for FI, but regulators warn against bankruptcies from mismanagement.

6. Save and Invest Wisely

Savings and investments are another key factor towards financial independence. As such, it’s important to save and invest wisely to increase the money we can set aside for a financially independent future. Let’s learn more about different types of investment strategies, contributions to retirement accounts and savings accounts to effectively save and invest our money. Deposits into FDIC-insured accounts ensure safety for depositors.

It’s also important to set aside an emergency fund for times of crisis. Life isn’t always predictable, and an emergency fund can help us avoid unexpectedly spending our savings. It’s your ticket to stay on track toward FI. Technology, like robo-advisors from financial institutions, can optimize investment choices.

7. Continuously Monitor and Adjust Your Financial Plan

As our lives go on and changes over time, we also have to review and adapt our financial plan to our financial situation. We may find ourselves suddenly earning more, allowing us to put more money toward our savings and speeding up the timeline to financial freedom. On the other hand, losing income may mean having to look for additional income and becoming more mindful and frugal about our spending. Staying familiar with banking trends helps us make sharp adjustments.

Faced with these changes, our financial plan also has to shift. Reviewing our plan and taking the steps to adapt to these life changes helps us stay on track to meet our financial goals. Tools like financial planning software can play a key role in this process.

Building Wealth for Financial Independence

Sources of Income for Financially Independent Individuals

As we’ve established, financial independence is being able to live without the need to actively work the usual full-time job. Our personal wealth can come from our savings and other sources of income. This includes:

Passive income,

Investments,

Side hustles, and

Retirement income

Passive income can come from royalties, rentals, interest, and more. One form of passive income are dividends from investments. Investments, on the other hand, can also appreciate in value, exponentially increasing the money you invested over time. These can comes from stocks, bonds, mutual funds, and more. Intermediaries like financial institutions often facilitate these investments, ensuring alignment with your goals.

While financial independence may mean not having to work from 8 AM to 5 PM, we also have the option to comfortably build our wealth with side hustles. Freelancing, flexible work, content creation, and other side hustles allow us to earn money even as we enjoy our financial freedom. Developers of platforms hosting these gigs are key players in this space.

Lastly, retirement income are the rewards we reap from years of work. They’re key sources of income as we live a retired life. Retirement income can come from pension plans, 401(k)s, individual retirement accounts (IRAs), annuities, and more. While we’re still working, contributing to these retirement plans and accounts can benefit us greatly in the future. Insurance products, like annuities from financial institutions, can further secure this income.

Wise Investment and Economic Discipline for Long-Term Wealth

According to the Federal Reserve, 25% of non-retired adults in the United States in 2022 didn’t have any retirement savings, a crucial part of working toward financial independence. Without making smart financial decisions and staying disciplined in our plans, we can’t secure financial independence or enjoy early retirement. Mistakes here can pull you off track, but science-backed strategies can help.

A key part of FIRE is aggressively saving, wisely investing our income, and frugally minimizing our expenses. Often that means going beyond and investing a large percentage of what we earn than what most people do. However, it’s exactly this principle and philosophy of the movement that allows us to achieve FIRE. As our retirement savings grow and we build our personal wealth, the more likely we’re able to enjoy financial stability and freedom for the years to come. Banking systems and tools from financial institutions provide the infrastructure for this growth, functioning as the backbone of wealth-building in the world.

Becoming Financially Independent: A Journey Worth Taking

A life of financial independence, the freedom to live our lives to the fullest without being held back by money, is the dream life. However, it’s a goal that requires careful financial planning, seriously saving, and disciplined spending to achieve. From this moment, you can begin to take steps toward it.

What FI looks like differs for each of us. We have different situations and goals that we want to achieve, and these often change over time. With a sound financial plan and expert help from a professional, we can take the road toward financial independence. As we enjoy our dream life in the later years, we’ll know that it’s surely a journey worth taking to feel financially independent and secure. The word of FI literally leads to a vision of freedom, and with the right ticket, you can make it a reality.